NVIDIA First Quarter Result 2026

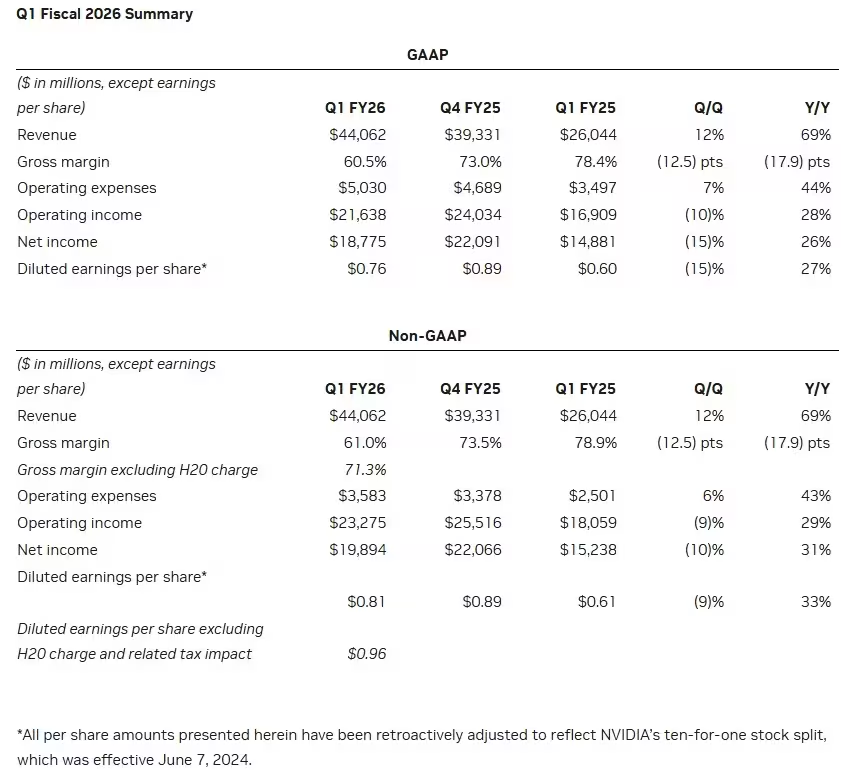

NVIDIA today released remarkably strong performance record revenue for Q1 FY2026. For the first quarter ending April 27, 2025, the company reported impressive revenue of $44,062 billion, reflecting a 12% increase from the previous quarter and a notable 69% year-over-year growth. These outstanding results highlight NVIDIA’s continued success in driving innovation within the AI space. A significant portion of this growth stemmed from its thriving Data Center business, which generated $39,331 billion in revenue — up 10% from Q4 FY2025 and 73% higher than the same period last year. This momentum demonstrates the increasing global reliance on NVIDIA’s AI infrastructure as industries accelerate their adoption of advanced AI technologies.

⚠️ U.S.-China Tensions Disrupt H20 Shipments

NVIDIA faced a sudden turn of events on April 9, 2025. The U.S. government had straightforwardly told the tech company that it would require a license to export the H20 AI chips to China—they had to pay for these H20 add-ons—and this became a serious issue. As if overnight, the demand for these chips in one of their main markets suddenly dropped. NVIDIA was staring down the barrel of a $4.5 billion bullet due to unsold inventory and supply contracts that could not be put on hold.

Before the changes came into effect, NVIDIA managed to rake in $4.6 billion in sales from H20, with regulatory headwinds working against them. Alas, success does not come without costs, and NVIDIA had to bear $2.5 billion in orders that were constrained due to crippling export restrictions.

With that being said, the company’s overall performance remained mostly unbothered. Both GAAP and non-GAAP gross margins stood at 60.5% and 61.0%. The non-GAAP gross margin without the H20 charge would have ballooned to $71.3%. Which paints a good picture for the company—its core business is stronger than ever.

Earnings per share were reported as $0.76 for GAAP and $0.81 for non-GAAP. If one disregards the impact of the H20 charge and its tax effects, the non-GAAP diluted EPS would adjust upwards to $0.96. This underscores NVIDIA’s mounting earnings capabilities, even while facing regulatory headwinds.

NVIDIA today reported record revenue for Q1 FY26 of $44.1 billion, up 12% from the previous quarter and up 69% from a year ago.

— NVIDIA Newsroom (@nvidianewsroom) May 28, 2025

The company announced data center revenue of $39.1 billion, up 10% from Q4 and up 73% from a year ago.

Full breakdown ⬇️ https://t.co/3slHxNc5uW

🧠 AI Infrastructure: The Growth Engine

CEO and founder Jensen Huang NVIDIA has underscored the company’s strategic momentum, pointing out the increased production for the Blackwell NVL72, a new AI supercomputer tailored specifically for reasoning-centric tasks which propels NVIDIA’s infrastructure forward. Huang exclaimed, “Global demand for NVIDIA’s AI infrastructure is incredibly strong.” Huang agreed,” AI inference token generation has increased tenfold in the past year alone. The need for powerful AI computing will only grow, and VGA is at the core of this transformation AI becoming part of everyday life.” Huang further noted, “Nations worldwide are recognizing AI, crucial infrastructure much like electricity and the internet.”

💸 Shareholder News

In their last meeting, NVIDIA also reiterated their previous strategies concerning returning value to shareholders by disclosing their next quarterly cash dividend of $0.01 per share payable on July 3, 2025, to all shareholders of record on June 11, 2025.